For questions about your pension, contact the New York State Teachers Retirement System: 518-447-2900

For questions about benefits offered by the district in retirement, please call Annette Sicuranza: 516-441-4037

For questions about what retirees receive from GNTA’s Benefit Trust Fund, contact Kevin Chavarria at the Dickinson Group: 516-740-5337

If you are a "newer" teacher and would like to preview Stacey Braun's webinar geared for your financial planning, check out: From Hire to Retire – Financial Planning for Newer Teachers (Years 1-10)

For questions about benefits offered by the district in retirement, please call Annette Sicuranza: 516-441-4037

For questions about what retirees receive from GNTA’s Benefit Trust Fund, contact Kevin Chavarria at the Dickinson Group: 516-740-5337

If you are a "newer" teacher and would like to preview Stacey Braun's webinar geared for your financial planning, check out: From Hire to Retire – Financial Planning for Newer Teachers (Years 1-10)

NYSTRS ANNUAL DELEGATE REPORT AND RESOURCES

NYSTRS’ 2023 Delegates Meeting was held Nov. 5-6 at the Saratoga Springs City Center. Nearly 600 delegates from across the state participated in the meeting, which featured educational presentations about NYSTRS' benefits and the strength and stability of the pension system.

Following are videos and slides from the presentations and sessions conducted at the Delegates Meeting.

The Role of the Delegate: As a delegate, you have two important functions: elect a teacher member to NYSTRS’ Board and serve as a System ambassador to your peers. Learn about our various resources to keep you and your fellow teachers informed about your benefits and to plan for retirement.

Social Security Information: What do you need to know? We review key information, including benefit eligibility, calculations, taxes, earnings limits and cost-of-living adjustments.

Tier 6 Overview: Learn key information about Tier 6, including member contributions and eligibility for benefits.

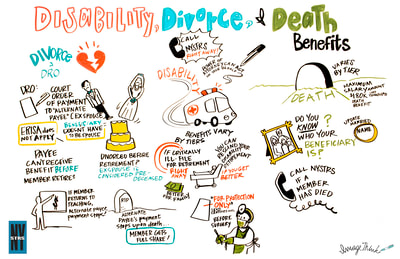

Legal Update: Review of POAs, DROs and Trusts: Learn about important legal documents, including Power of Attorney (POA), Domestic Relations Orders (DRO) and trusts.

Play “Retirement Quest” with Host Mr. Max Benefit: We invited delegates to the stage to play our new game show “Retirement Quest” hosted by Mr. Max Benefit. Two teams of delegates navigated their way through the career stages to make it to Retirement. Contestants answered questions about a member’s early-, mid- and late-career stage to win Retirement Quest! A panel of NYSTRS’ Expert Guides provided insight on the answers and contestants received prizes!

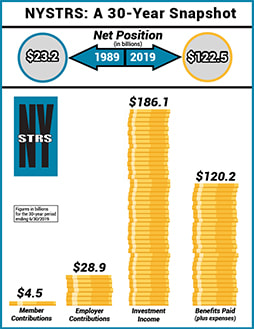

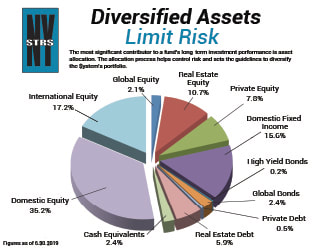

The Strength and Stability of the System: Learn about NYSTRS’ funding and investment philosophies and how they lead to long-term success, strength and stability. We provided an overview of the health of the Retirement System and the thoughtful approach to managing the System’s assets.

Yours in solidarity,

Jen, Frank, Luci and Patti

Following are videos and slides from the presentations and sessions conducted at the Delegates Meeting.

The Role of the Delegate: As a delegate, you have two important functions: elect a teacher member to NYSTRS’ Board and serve as a System ambassador to your peers. Learn about our various resources to keep you and your fellow teachers informed about your benefits and to plan for retirement.

- Watch The Role of the Delegate video

Social Security Information: What do you need to know? We review key information, including benefit eligibility, calculations, taxes, earnings limits and cost-of-living adjustments.

Tier 6 Overview: Learn key information about Tier 6, including member contributions and eligibility for benefits.

- Watch Tier 6 Overview video

- Download presentation slides

Legal Update: Review of POAs, DROs and Trusts: Learn about important legal documents, including Power of Attorney (POA), Domestic Relations Orders (DRO) and trusts.

Play “Retirement Quest” with Host Mr. Max Benefit: We invited delegates to the stage to play our new game show “Retirement Quest” hosted by Mr. Max Benefit. Two teams of delegates navigated their way through the career stages to make it to Retirement. Contestants answered questions about a member’s early-, mid- and late-career stage to win Retirement Quest! A panel of NYSTRS’ Expert Guides provided insight on the answers and contestants received prizes!

The Strength and Stability of the System: Learn about NYSTRS’ funding and investment philosophies and how they lead to long-term success, strength and stability. We provided an overview of the health of the Retirement System and the thoughtful approach to managing the System’s assets.

Yours in solidarity,

Jen, Frank, Luci and Patti

GNPS AND GNTA BENEFITS IN RETIREMENT 2023

Your browser does not support viewing this document. Click here to download the document.

|

|

Stacey braun's financial planning webinar 2023

The Vimeo link below is for Stacey Braun’s financial planning webinar for new teachers. In it they discuss:

vimeo.com/868822810/70e78c43ba

- Tier 6

- Basics of 403b and 457b plans

- Saving early

- Buying a home

- Debt and Credit

- Student Loans

vimeo.com/868822810/70e78c43ba

resources for retirees |

Learning about nystrs |

DID YOU KNOW?

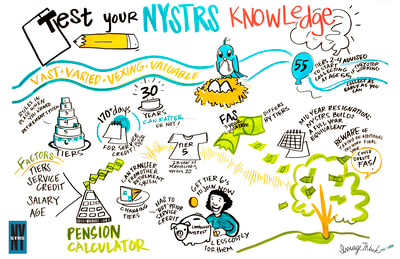

For Tier 2-5 members, your FAS is generally the average of your highest three consecutive school years of salary earned, whenever they occurred in the salary history. Tier 6 members must use a five-year FAS with restrictions on includable salaries.

|

Your browser does not support viewing this document. Click here to download the document.

Your browser does not support viewing this document. Click here to download the document.

Your browser does not support viewing this document. Click here to download the document.

|

Your browser does not support viewing this document. Click here to download the document.

Your browser does not support viewing this document. Click here to download the document.

|

EMPLOYER CONTRIBUTION RATE (ECR)

|

Your browser does not support viewing this document. Click here to download the document.

SERVICE CREDIT

1 Year of Credit

You will be eligible to purchase credit for prior service. For more information, see our publication You Deserve the Credit. 5 Years of Credit If you are a Tier 3 or 4 member, your pension will be vested, and you will be eligible for a NYSTRS service retirement benefit at age 55. 10 Years of Credit

20 Years of Credit

25 Years of Credit

30 Years of Credit

35 Years of Credit

It is important to HAVE ALL THE CREDIT FOR WHICH YOU ARE ELIGIBLE because your total service credit impacts your eligibility for NYSTRS benefits — and often the amount of those benefits. The following types of service can build your credit and help you reach important service milestones:

This information is meant to serve as a guideline. As always, go to NYSTRS.org for the most current information. |

NYSTRS presentation given by Trustee Ron Gross to GNTA & SAGES

Your browser does not support viewing this document. Click here to download the document.